As a financial advisor, you know that communication is everything. It’s not just about investment strategies, financial goals, or the nitty-gritty of portfolio management—it’s about building a relationship with your clients.

And one of the most effective tools at your disposal? A thoughtful, personalized letter.

In an age of digital overload, a well-crafted letter stands out. It shows that you’re not only managing their financial plans, but you’re also investing in them as individuals. Whether it’s a market update, an annual review invitation, or even a congratulatory note on a life event, these letters keep your clients engaged and connected.

And the best part? You don’t have to start from scratch. We’ve been helping the professionals in the asset management industry craft effective letters for over 40 years, and we’ve seen firsthand how these small touches can strengthen relationships and drive growth. So much so that we have a financial advisor content library with over 2,000 letters.

With that said – if you’re looking to craft your own letter to send to clients, we’ve created this guide.

Below, we’ll walk you through the different types of letters investment advisers send, the essential elements that make them effective, and provide sample templates that our advisors use to save time, drive referrals, and provide top notch client service.

Why Client Communication Matters

Client communication is more than just keeping them informed or pitching a product. It’s about positioning yourself as their go-to advisor in every aspect of their financial life—whether it’s retirement planning, investment management, or estate planning. Your clients want to know you’re thinking about their financial future, even when they’re not.

Building Trust and Deepening Client Relationships

Regular, personalized communication reminds your clients that you are committed to their financial success. Trust doesn’t just happen overnight. It’s built slowly, with every thoughtful email, check-in call, and yes, every letter you send.

Example: You’ve worked with a client for years, managing their investments and cash flow. But when they get a letter about a portfolio update tailored to their financial situation, something clicks. It’s more than just an update—it’s reassurance. They see that you’re monitoring their progress, and it reaffirms why they chose you.

Retaining Clients and Sparking Referrals

Clients who feel valued are more likely to stay loyal, and they’re also more likely to refer their friends, family, or colleagues. A simple, well-timed letter can remind them of the value you provide and prompt them to share your services with others.

Professionalism and Compliance

Beyond trust and referrals, your letters must reflect professionalism. Clear communication about investment management or financial planning doesn’t just help the client—it also ensures you’re compliant with FINRA and fiduciary standards, especially if you’re a CFP® designee or bound by broker-dealer requirements. Every letter is a chance to reaffirm your role as a trusted advisor.

Key Components of a Great Financial Advisor Client Letter

We’ve covered the “why”—now let’s focus on the “how.”

Writing an effective letter isn’t about filling the page with words. It’s about crafting something thoughtful, intentional, and most importantly, personal.

When done well, a letter can be a moment of connection, a reaffirmation of your commitment to your client’s financial health.

So, let’s break down what every letter should include to ensure it’s professional, personal, and impactful.

Headline & Greeting: Start with Relevance and Connection

The opening sets the tone. A strong headline isn’t just a label—it’s an invitation to read further. Think of it like this: you wouldn’t start a conversation with a vague remark, so why start a letter that way?

Personalization is key.

Use something like: “What Q3 Means for Your Retirement Plan” or “Your Portfolio: Preparing for What’s Next.”

Make it clear from the start that this letter is about them and their financial future.

Then, greet them like a person—not a number on a spreadsheet.

“Dear [Client’s Name]” isn’t just a formality; it’s the first step in making the letter feel like a one-on-one conversation. You’re showing them this is not a mass communication—it’s a direct message from you to them. In a world of automated everything, that touch of personal recognition means more than you might think.

Introduction/Context: Set the Stage and Get to the Point

Your client’s time is valuable, so respect it by cutting straight to the point—but with context. Every letter should immediately address why you’re writing and what’s in it for them.

For example, if it’s a market update, try:

“I’m writing to keep you updated on recent market movements and how they may affect your portfolio.”

Or if it’s an annual review invitation:

“As the year comes to a close, I’d like to invite you to review your financial plan and see how we’re progressing toward your retirement goals.”

The introduction is about making sure they understand why this matters—not to the world of finance in general, but to their unique situation. It’s the “you” factor. Remember, every line should focus on their financial story, not just a broad market narrative.

Main Message: Speak to Their Financial Journey

This is where the core of your message lives, and it should never feel like boilerplate language. Whether you’re giving a portfolio update, discussing tax strategies, or preparing them for an annual review, the focus must always come back to their financial goals.

Investment Management Updates: Don’t just talk numbers. Talk strategy.

Example:

“Based on your goal of retiring at 60, we’ve adjusted your portfolio’s asset allocation to better weather the market fluctuations we’ve seen this quarter. We’re keeping your long-term strategy intact while minimizing short-term risks.”

Here, you’re not just telling them what you did—you’re reminding them that every move you make is connected to their bigger picture.

Financial Planning Reminders: Annual reviews aren’t just a box to check—they’re a chance to reassess and refocus. Use this as an opportunity to celebrate their milestones and realign with their goals.

Example:

“You’ve made great progress toward your retirement savings goals this year. During our review, we’ll also discuss how we can further optimize your contributions and explore potential tax-saving strategies.”

In both cases, the main message needs to highlight how your actions are helping them move closer to their financial objectives. Clients want to feel that you’re always thinking strategically on their behalf.

Call to Action (CTA): Make the Next Step Clear

Don’t leave them guessing. Every letter needs a clear, actionable next step. Whether it’s scheduling a meeting, updating their estate plan, or simply confirming their portfolio strategy, make it easy for them to follow through.

Example CTA:

“Let’s schedule a meeting next week to discuss how the recent market changes impact your portfolio and review any adjustments that might be needed.”

The goal here is simple: guide them toward action. You’ve set the context, delivered the core message, and now you’re leading them to the next step in the journey. A strong CTA keeps the momentum going and turns the letter from passive information to active engagement.

Closing Remarks: Reaffirm Your Commitment and Leave a Personal Note

The closing is more than just a formal goodbye—it’s a chance to reinforce trust and commitment. Think of it as your opportunity to remind them that you’re on their side, working for them.

Be warm, yet professional:

“I look forward to continuing to guide you toward your financial goals, ensuring we’re always aligned with your long-term plans.”

Offer reassurance: Clients appreciate knowing that you’re always keeping an eye on their portfolio, even when they’re not. For example, if you have discretionary trading authority:

“As always, rest assured that I’m closely monitoring your investments and will make adjustments as needed to keep you on track.”

It’s a small touch, but it makes a big difference. You’re telling your client, “I’m here, I’m paying attention, and I’m committed to your success.” It’s a final reminder that you’re not just managing their money—you’re building their financial future with them.

Financial Advisor Letter Template Samples

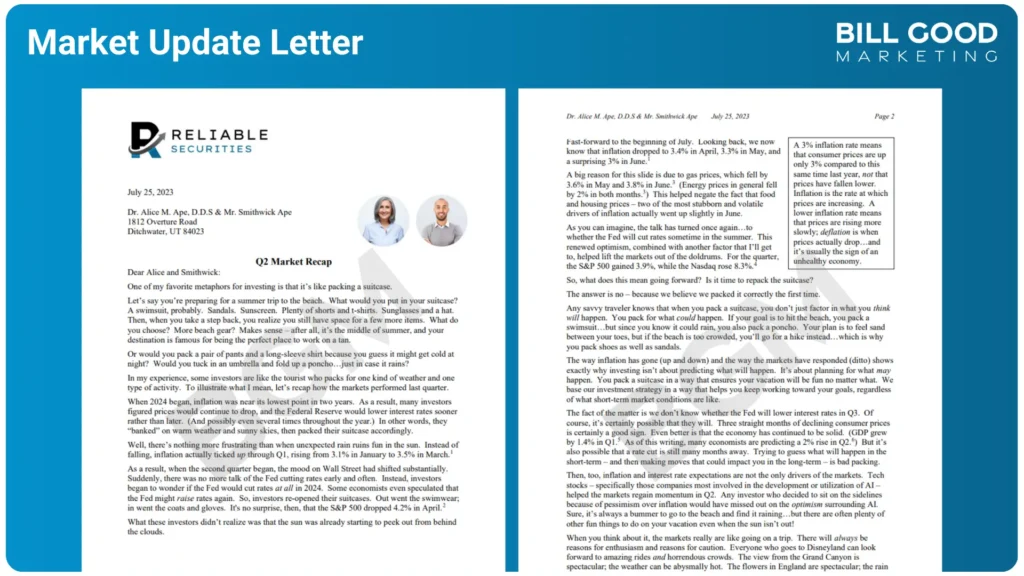

1. Market Update Letters

These letters are your chance to inform clients about important market changes and how these changes impact their portfolios. Keep the message clear and avoid overwhelming clients with too much jargon. Highlight how the changes may affect their investment strategies and the actions you’ve taken to adjust their portfolio accordingly.

- Sample Market Update Letter: This letter explains how the market’s recent shifts may impact the client’s portfolio, along with reassurance that you are keeping a close eye on everything to keep them on track toward their financial goals.

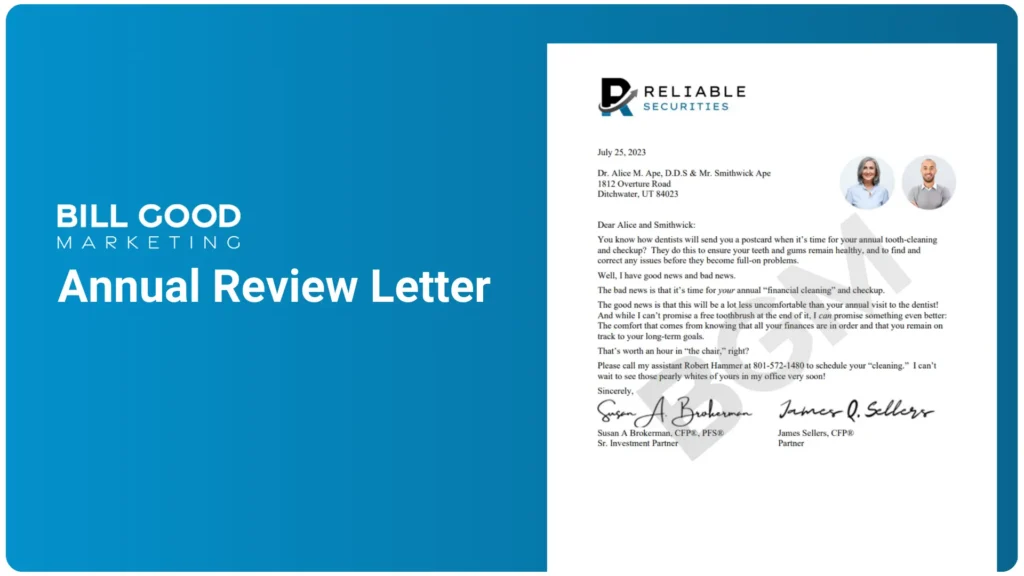

2. Annual Review Invitations

These letters invite clients to review their financial objectives and make adjustments as needed. Personalize them by mentioning specific life events or changes in their net worth. You can also include suggestions for discussing topics like retirement planning, estate planning, or updating their financial situation.

- Sample Annual Review Invitation: This letter invites a client to an annual review, focusing on their financial planning process, retirement objectives, and portfolio updates.

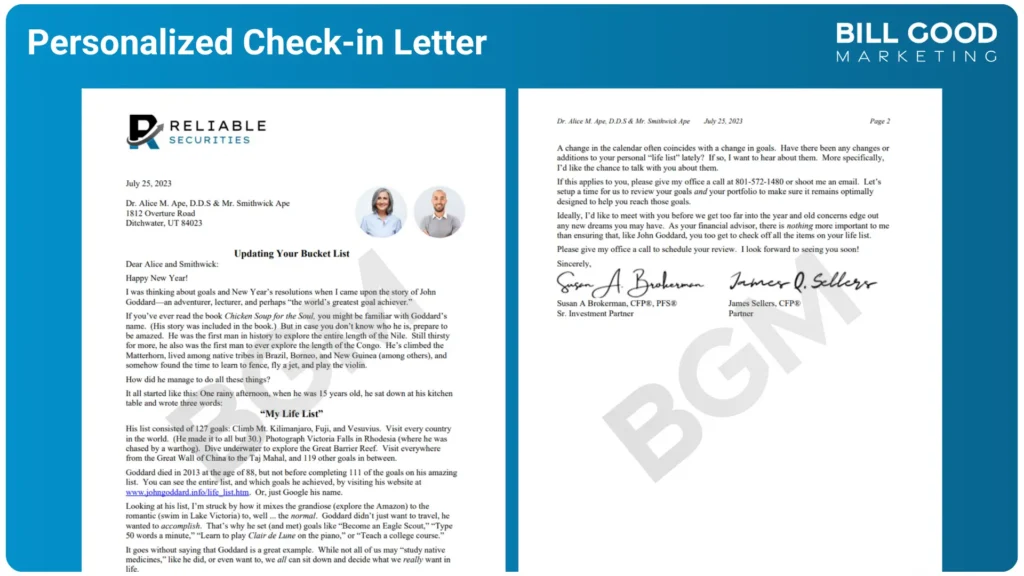

3. Personalized Check-In Letters

Sometimes, a simple check-in is all you need to show clients you’re thinking of them. Use these letters to touch base, ask about any recent changes in their life, and offer to review their investment portfolio. These letters are great for maintaining strong client relationships.

- Sample Check-In Letter: A simple, friendly check-in asking if they’re feeling confident about their current financial plan and inviting a discussion on any potential changes to their investment portfolio.

4. Life Event Letters

Congratulate clients on major milestones—whether they’ve retired, welcomed a new family member, or made a big purchase. Acknowledge how these life changes may impact their financial planning and offer to discuss new strategies or adjustments to their portfolio.

- Sample Life Event Congratulation Letter: A personalized message congratulating the client on a significant life event (e.g., welcoming a new grandchild).

Best Practices for Writing Client Letters

1. Be Personal, Not Generic

You know that client who forwarded you a chain email with no subject line? That’s what a generic letter feels like. It’s easy to fall into the template trap, but here’s the truth: personalization is everything.

A letter tailored to your client’s unique situation says, “I see you. I understand where you are, and I’m here to help you get where you want to go.”

Mention their financial goals, acknowledge their life events, refer to the last conversation you had. Make them feel like they’re your only client because, in that moment, they are.

A generic letter is forgettable, but a personal one? That builds trust and deepens relationships.

2. Stay Clear and Concise

The world is noisy. Your clients don’t want another cryptic message that leaves them scratching their heads.

What they crave is clarity. Simplicity wins.

Strip away the jargon, the endless charts, the acronyms that require a finance degree to decode. Talk to them like you would over coffee.

Be direct, be transparent.

When you make things easy to understand—whether it’s discussing risk management or portfolio allocation—you show that you respect their time and their intelligence. Clear communication is a superpower. Use it well.

3. Provide Value

Here’s a hard truth: your letter is not about you.

It’s about your client.

Every letter you send should offer something of value. It might be reassurance during turbulent markets, education on a new investment strategy, or an invitation to review their portfolio.

Whatever it is, make sure it serves them.

Always ask yourself: What’s in it for the client?

If you can’t answer that, it’s time to rethink the message. A letter that provides clear, actionable value is a letter that gets remembered—and acted upon.

Bill Good Marketing: Helping Financial Advisors Build Relationships for Over 45 Years

In the world of financial services, your role as a financial planner/advisor goes far beyond balancing portfolios or selecting investment products. Your clients don’t just rely on you for wealth management; they lean on you for guidance through the inevitable twists and turns of their financial lives. You’re their anchor, their trusted confidant, the person who can translate market volatility into opportunity and uncertainty into clarity.

And here’s the thing: trust doesn’t always come from quarterly performance reports or data-heavy presentations.

Sometimes, trust is built through something as simple, yet profound, as a letter.

A letter that doesn’t just inform but connects. A letter that reassures your clients when the markets are choppy and celebrates with them when goals are met.

This isn’t about transactionality—it’s about connection. About showing that you’re not just their investment advisor, but their partner in securing their financial future.

For years, we’ve helped hundreds in the advisory services space create client letters that do exactly that. Letters that don’t just speak to numbers, but to people. Letters that transform client relationships, turning them into long-term partnerships rooted in trust. And the best part we have thousands to choose from.

Ready to elevate your client communication?

We’ll help you craft letters that reflect your expertise, deepen relationships, and make your clients feel seen, heard, and understood. Because a well-written letter isn’t just correspondence—it’s an essential part of your wealth management strategy, and it’s an investment in your client’s success.

So, let’s take your communication to the next level. Contact us today, and let’s ensure your next letter is more than just a note—it’s the start of something powerful.

About the Author

Andrew D. White is the Director of Marketing at Bill Good Marketing, a firm with over 45 years of experience helping financial advisors scale their businesses. With deep expertise in advisor marketing, client acquisition, and retention strategies, Andrew specializes in creating high-impact campaigns that drive measurable results. His insights are grounded in real-world experience, working alongside top-performing advisors to refine prospecting, branding, and practice management strategies.