Direct mail marketing may be considered “old-school”; but its results are timeless.

For financial advisors looking to connect with their target audience—whether it’s millennials starting their financial planning journey or retirees preparing for retirement—this strategy is not only cost-effective but proven. With response rates up to nine times higher than digital ads, it’s clear that when done right, snail mail works.

The key phrase? When done right.

From the envelope to the message, every detail matters. Your call to action needs to be irresistible. Your content? Engaging enough to make them pick up the phone, scan a QR code, or attend your seminar.

Direct mail is no longer about bulk marketing—it’s about thoughtful, targeted communication that drives conversions and builds trust.

Done correctly, direct mail marketing doesn’t just fill seminar seats or increase phone calls. It builds brand awareness, strengthens your position as a financial services provider, and, most importantly, turns qualified prospects into loyal clients.

Let’s dive into how to make this timeless marketing strategy work for you. Because when it’s done right, direct mail isn’t just relevant—it’s revolutionary.

The Unique Advantages of Direct Mail

Unlike digital marketing, where your carefully crafted message is just another unopened email lost in a sea of 120 daily notifications, direct mail lands directly in your target audience’s hands. Physical mail is tangible. It has weight. It engages more senses than a glowing screen ever could.

For financial advisors, this is a golden opportunity.

The people you want to reach—millennials planning for their future, retirees preparing for retirement, or business owners seeking strategic advice—are craving something real. Something they can hold and read at their own pace. Something that isn’t just another ad in their social media feed.

Higher Open and Response Rates

Here’s why direct mail marketing shines: the numbers don’t lie.

Here are the stats from smallbizgenius.net along with a bit of my commentary.

“The average American household receives 454 pieces of marketing mail per year.”

The USPS does not deliver mail on Sundays or the ten Federal holidays. That means they do deliver 303 days per year. And that means the average American consumer is receiving about 1.49 pieces of marketing mail per day.

“By comparison, the average office worker receives 120 emails every day.”

“The response rate for direct mail is up to nine times higher than that of email.”

“57% of email addresses are abandoned because the user receives too many marketing emails.”

Again, think 1.49 pieces of mail versus 120 emails per day.

“Up to 90% of direct mail gets opened, compared to only 20-30% of emails.”

And that’s at the high end, with a clean list.

“73% of American consumers say they prefer being contacted by brands via direct mail because they can read it whenever they want.

Advertising mail is kept in a household for 17 days on average.”

Why?

Because in a crowded world, a thoughtful, well-designed direct mail piece stands out. It’s not competing with pop-ups or notifications. It’s just there, waiting to be read—and it often is.

And it’s not just about being seen. Direct mail drives action. Whether it’s signing up for a webinar, calling your office, or even scanning a QR code to learn more about your services, direct mail makes it easy for potential clients to take the next step. Conversions happen when the message is clear, personal, and actionable.

Building Trust and Credibility

But there’s something even more powerful at play: trust.

When you send a thoughtfully written client letter, you’re not just marketing your services—you’re building relationships. You’re positioning yourself as the go-to provider of financial services for your clients’ needs, whether it’s retirement planning, financial planning, or simply being the voice of reason in uncertain times.

And here’s the thing: trust isn’t built through a flashy campaign or one-time effort.

It’s earned, piece by piece, letter by letter. Over time, your mailers reinforce your brand as a trusted financial advisor who takes the time to connect personally. That’s a game-changer in an industry where relationships are everything.

So, while everyone else fights for fleeting attention in the digital world, your direct mail marketing strategy cuts through the noise. It connects. It converts. And, most importantly, it builds something real.

Let’s talk about how to do it right. Because when you harness the full potential of direct mail, it’s not just an envelope—it’s an opportunity.

The Anatomy of a Successful Direct Mail Campaign

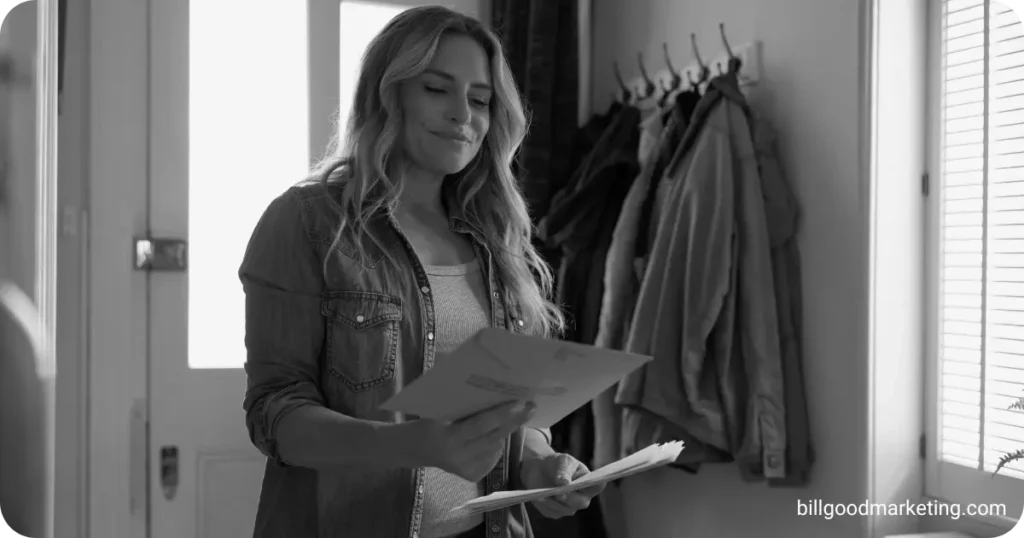

Picture this: a potential client shuffles through their daily mail.

Bills, grocery coupons, a bland postcard from a local business—and then they stop.

An envelope catches their eye.

It’s different.

It has a real stamp, maybe even a commemorative one. Their name is handwritten, not printed.

Something about it feels… important. Intrigued, they open it.

That’s the magic of a well-executed direct mail marketing campaign.

It’s not about sending “just another mailer.” It’s about crafting a moment of connection in an otherwise routine day. For financial advisors, this is your golden opportunity to stand out, create trust, and ultimately drive action. But to get there, every detail matters. Let’s break it down.

1. The Envelope: The Unsung Hero

An unopened envelope is a failure. Plain and simple.

The envelope is your gatekeeper. If it doesn’t intrigue your recipient, your message might as well not exist. But when done right, it becomes an irresistible invitation to engage.

- Stamps Matter: Use a real stamp—better yet, a commemorative one. Why? A stamped envelope signals personal importance, not mass marketing. It whispers, “Open me.”

- Personalization Works: A handwritten address or a well-placed teaser line like “Important Information About Your Financial Future” grabs attention. But it must feel authentic, not gimmicky.

- Quality Counts: Cheap envelopes scream indifference. High-quality materials, clean design, and attention to detail show you care—and that your message is worth their time.

The envelope sets the stage. Make it count.

2. The Direct Mail Piece: Words That Work

Once the envelope is opened, the real challenge begins. Your physical mail needs to do more than inform. It needs to connect, persuade, and move your prospect to action. Here’s where most campaigns fall flat—the writing.

The hardest part of direct mail marketing isn’t designing the envelope or choosing the format. It’s deciding what to say. Crafting a message that resonates with your target audience, addresses their pain points, and offers a compelling solution is both an art and a science.

At Bill Good Marketing, we’ve spent decades perfecting this. With the largest content library in the financial services industry, we’ve already solved the hardest part for you. Our letters are tested, refined, and designed to drive results. Whether you need a long-form letter that builds trust or a quick note that sparks interest, we’ve got you covered.

3. Formats: Choosing the Right Tool for the Job

Not all messages are created equal, and not all audiences respond to the same approach. The format of your direct mail campaign should align with your goals, your audience, and the complexity of your message.

- Long Letters: Perfect for explaining intricate topics like retirement planning or financial planning. These letters position you as an expert, guiding your readers through their challenges and offering clear solutions.

- Postcards: Great for quick, high-impact messages—like an invitation to a seminar, a webinar, or a link to your latest podcast episode.

- Brochures: Ideal for showcasing your range of services or introducing yourself to new clients.

Think about your demographics. A retiree might appreciate a detailed letter outlining estate planning strategies. A millennial may prefer a visually engaging postcard that highlights your expertise in investment management. The format isn’t just a container for your message—it’s part of the message itself.

4. Personalization and Segmentation: The Secret Sauce

Mass marketing is a relic of the past. Today, it’s all about speaking directly to the individual. That’s where segmentation comes in.

Your audience isn’t one-size-fits-all, and your message shouldn’t be either. Group your clients and prospects by their needs and demographics —retirees, business owners, young families—and craft messages that feel tailored to them. The more personal your mailer feels, the higher your response rates and conversion rates will be.

5. The Follow-Up: Turning Interest into Action

Here’s the thing: the letter is just the beginning.

A truly successful direct mail marketing campaign doesn’t end when the envelope is opened. It ends when your recipient takes action.

- Call-to-Action (CTA): Make your next step clear and compelling. Whether it’s calling your office, scanning a QR code, or signing up for a seminar, your CTA should be easy to follow.

- Integrated Touchpoints: Pair your snail mail with digital strategies. Follow up with a phone call, send a targeted email, or connect on LinkedIn. These touchpoints create a cohesive experience that builds trust and drives engagement.

Why Direct Mail Works

Done right, direct mail marketing doesn’t just fill seats at your seminars or bring in a handful of calls. It builds relationships. It positions you as a thought leader in the financial services industry. And it keeps you top of mind when your audience needs a trusted guide for their financial journey.

With the right message—and yes, we can help with that—a direct mail piece becomes more than just a letter. It becomes the start of a conversation, the beginning of trust, and the first step toward action.

Combining Direct Mail with Digital Strategies

Direct mail isn’t just a standalone effort—it’s the foundation of something bigger. The world has shifted, and so have your clients’ expectations. They don’t live exclusively in physical mailboxes or digital inboxes. They toggle between the two, seamlessly blending their offline and online worlds. The magic happens when you connect these worlds.

Here’s where direct mail marketing truly shines: as a launchpad for deeper engagement.

When paired with smart digital strategies, your campaign doesn’t just drive responses—it builds lasting relationships.

The Power of Integration

Think about this: a prospective client receives your direct mail piece—a beautifully written letter inviting them to explore retirement strategies.

At the bottom, there’s a QR code.

They scan it with their phone, and within seconds, they’re watching a video on your website, joining your webinar, or downloading a guide that answers their exact question. This isn’t just mail.

It’s an experience.

A direct mail piece with a digital touch turns curiosity into action and action into measurable results.

- Web Traffic Boosts: Use personalized URLs (PURLs) to direct recipients to landing pages tailored just for them. These pages can showcase your expertise in financial planning, highlight testimonials, or offer tools like calculators for retirement savings.

- Social Media Connections: Include a call-to-action that encourages recipients to follow you on LinkedIn or explore your content on other platforms. This creates ongoing touchpoints beyond the initial letter.

- Email Integration: After sending a mailer, follow up with an automated email that reinforces the message. “Did you receive my letter? Here’s a quick link in case you missed it.”

Tracking and Measuring Success

One of the greatest advantages of integrating digital tools into your direct mail marketing campaign is the ability to track and measure results.

- QR Codes for Real-Time Insights: Each scan tells you who’s engaging and how.

- Call Tracking: You can use unique phone numbers for each campaign to measure the volume of inquiries generated.

- Conversion Analytics: Pair direct mail with CRM tools to see how it impacts your overall lead generation and sales funnel.

You’re not just guessing whether your campaign worked—you have the data to prove it.

A New Era of Connection of Financial Advisors

This isn’t about choosing between direct mail and digital marketing. It’s about using them together to create something greater than the sum of their parts. Your prospective clients aren’t asking for more noise—they’re asking for relevance.

When you send a letter that speaks to their needs and then guide them to an online resource that offers even more value, you’re not just marketing—you’re building a relationship.

And here’s the beauty of it: while everyone else is stuck thinking in silos—“It’s either snail mail or email”—you’re using both to create a unified, powerful, and measurable experience.

So, the next time you send a mailer, think beyond the letter. Think about where it leads. Because the journey doesn’t end when the envelope is opened—it begins.

Direct Mail Done Right — With Bill Good Marketing

Direct mail isn’t just a tactic. It’s a powerful bridge—connecting you directly to the clients and prospects who matter most. It’s personal, tangible, and memorable in a way no digital ad or email can replicate.

But here’s the catch: success in direct mail marketing is never accidental.

It’s the result of precise execution, thoughtful messaging, and a deep understanding of your audience.

For over 45 years, Bill Good Marketing has been the trusted partner for financial advisors and financial services companies looking to elevate their marketing efforts. We don’t just dabble in direct mail—we’ve mastered it. Our proven approach, combined with the largest content library in the industry, ensures your message lands exactly where it needs to—both in the mailbox and in the minds of your audience.

Why Financial Advisors Trust Bill Good Marketing

- Unmatched Expertise: Decades of experience crafting campaigns specifically for financial advisors and the challenges they face.

- Comprehensive Content Library: Thousands of templates, letters, and marketing assets covering just about every situation you can think of—from insurance and 401(K)s, to holidays and inspirational pieces.

- Tailored Solutions: Whether you’re running seminars, building out your marketing plan, or looking to bring in new clients, our content is designed to align with your goals.

- Multi-Channel Integration: Direct mail isn’t just about the letter—it’s about creating a seamless connection with your digital presence. We make using direct mail effortless as part of a broader strategy.

- Proven Results: With response rates that outperform industry averages, we’ve helped financial advisors like you turn mailers into measurable growth.

Direct mail isn’t outdated; it’s underutilized. While others are busy flooding inboxes with emails that go unopened, you’ll stand out with a thoughtfully crafted, tangible message that builds trust and drives action.

And with Bill Good Marketing, you’ll never have to wonder what to write or how to say it.

We know financial advisor marketing inside and out. We understand your audience, their pain points, and what moves them to act. From postcards to long-form letters, we’ve already done the heavy lifting—so you can focus on building relationships and growing your business.

The truth is, anyone can send mail. But few can make it matter. At Bill Good Marketing, we help you make every message count.

Real Success Stories from Financial Advisors Like You

At Bill Good Marketing, our direct mail campaigns don’t just get results—they create meaningful connections that drive long-term growth. Don’t just take our word for it—here are some real-life successes from advisors who have experienced the power of our letters firsthand:

Building Client Relationships with Ease

“The Letters Library contains the best collection of letters and information in one place. Bill’s birthday letters and special event letters are a big hit with my clients! Using them definitely saves me time, as I would never be able to write all the letters that the Letters Library has given me!”

– W.K., South Carolina, US

When time is limited, having ready-to-go, high-quality letters makes all the difference. Financial advisors like W.K. are able to stay connected with their clients while focusing on what they do best—helping them achieve their financial goals.

Turning Letters Into New Opportunities

“Over the last few months, we have mailed 4 letters to a 401(k) participant with a small account balance.

This morning, a guy stopped in the office and said, ‘I’ve been getting your letters and liked what I read; I wanted to come in to see you.’

His wife (the participant) just left her employer and now wants to roll her 401(k).

She also has a traditional IRA and a ROTH as well (all somewhere else). So does he.

They are selling a rental property and will have that cash available to invest as well. So he asked if we could help them with all of it…

He does not have email, but has six figures for us to invest.

Dear Bill: please stop marketing your System to my competitors. They could save a lot of money on postage.”

– C.N., Florida

The right message delivered at the right time can open doors to opportunities you might never have known existed. A thoughtful, consistent direct mail strategy turned a small account into a significant new client relationship—and substantial assets under management.

Cementing Multi-Generational Relationships

“Bill, these letters have helped us cement relationships with our clients. Interestingly, it’s also helping on the multi-generational front.

We have had a situation recently where a client passed away. We are keeping three out of the four kids.

One of them commented, ‘Dad kept all your letters. We found them. And read them. We love them too.’

We love the natural way, the no-sales way the letters are written. We are now able to talk to people through the letters. By the way, we have lots of tech people among our clients. Interestingly, they love getting physical letters.”

– B.U., Pennsylvania

Direct mail isn’t just about staying connected—it’s about building trust that lasts for generations. For B.U., thoughtful letters helped not only retain existing clients but also strengthen relationships with their families, ensuring long-term loyalty.

Ready to Elevate Your Direct Mail Strategy?

Take the first step toward transforming your marketing efforts with Bill Good Marketing. Click here and fill out the form to connect with our team.

Whether you’re looking to strengthen client relationships, bring in new prospects, or run a high-impact marketing campaign, we’re here to make it happen. Let’s work together to create direct mail that doesn’t just get opened—it gets results.

About the Author

Andrew D. White is the Director of Marketing at Bill Good Marketing, a firm with over 45 years of experience helping financial advisors scale their businesses. With deep expertise in advisor marketing, client acquisition, and retention strategies, Andrew specializes in creating high-impact campaigns that drive measurable results. His insights are grounded in real-world experience, working alongside top-performing advisors to refine prospecting, branding, and practice management strategies.