When and Why Do Referrals Happen?

The original version of this story was published on ThinkAdvisor®

Among the enduring myths in this industry is the idea: to increase referrals, all you have to do is ask. Generations of sales managers have harangued you on it. You have felt guilty because you didn’t do it. You have included it in countless business plans. And either you never did it, or if you tried, it didn’t work. In any case, you felt guilty for not living up to one of the commandments of sales.

Financial Advisor Referral Defined

For years I have taught that “a referral is a name volunteered.” Obviously, you cannot solicit something that must, by its nature, be volunteered. If you ask, you will NOT receive a referral. You are handed a name. These names a) are just names, and b) rarely become clients. Further, the process puts the client on the spot and makes you look unprofessional. (Imagine the dentist who says, “Who do you know with similar gingivitis I could call?”

These are conclusions I came to from experience. Now, I have hard data from the only study I know ever done of referrals.

The Facts Speak

In December 2010, Julie Littlechild, President of Advisor Impact, released a study of investors, “Anatomy of the Referral.” Sponsored by Schwab Advisor Services and conducted by Advisor Impact, the study gathered data on 1,034 advisory clients. The data was gathered in May 2010.

Every financial advisor should make this study required reading. Please go to www.advisorimpact.com. Choose your country. The link to receive a complimentary copy of the survey is in the upper left.

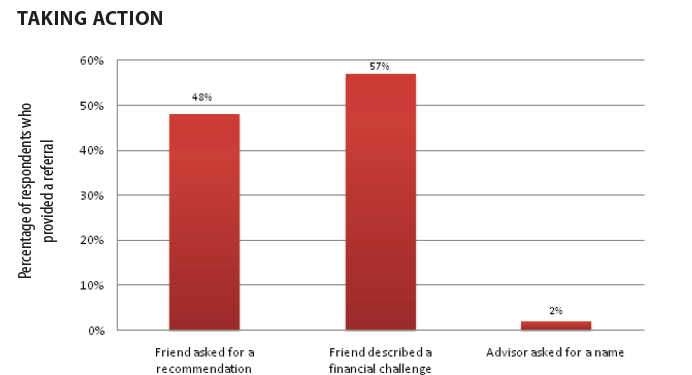

One of the questions on the survey is: “What were the circumstances of providing the last referral?”

Ms. Littlechild commented:

“What’s striking is that in only 2% of the cases did clients say that they referred because their advisor asked them for the name of her friend. If motivation to help an advisor was the only driver of referrals, then asking for a referral should work. The irony is that one of the most popular tactical approaches to increasing referrals among advisors has been to ask clients for the name of a friend. Our data suggests that this tactic is unlikely to work.”

Her data, and your own experience, suggest a stronger conclusion: Asking for referrals does not work. You should feel better, starting now, knowing you don’t have to engage in this fruitless, self-abasing procedure.

Who Refers?

“The Anatomy of a Referral” is an in-depth study of numerous service dimensions and their impact on client referrals.

Based on responses to a variety of these dimensions, Ms. Littlechild classified clients into four tiers.

- Disgruntled (12%)

- Complacent (39%)

- Content (25%)

- Engaged (24%)

By the author’s definition, the Engaged Client provides a referral.

Specifically, the Engaged Client is defined as: “one who meets three key criteria—a client who is satisfied, loyal, AND actively providing referrals.”

I have a serious issue with the number of “Engaged Clients” she found. No one I have spoken to reports anything close to receiving referrals from 24% of their clients. I emailed my concerns to the author.

With her kind permission, I am quoting from the email she sent: “The bigger issue is likely to be that they felt they provided a referral—which could have been a mention to a friend, but the introduction may never have happened, which may be a different issue.” She further stated, “So I don’t feel the issue is the numbers—they are what they are, and they are accurately reported. That said, we can rightly question if the clients have the same definition of referrals as we do.”

That should keep you up at night. Let’s say you have 300 clients. What if 75 of them are mentioning you to friends or colleagues, but you only learn about 10–20 of them. We are not then talking about referrals slipping through the hated cracks. We are talking about whooshing through gaping holes in the floor.

Why Clients Refer

The Engaged Client is very satisfied (ranks the primary advisor 8 out of 10 on a scale of satisfaction) and is extremely loyal. However, those characteristics do not automatically translate into referrals. Doing a better job does not guarantee more referrals.

“Despite the fact that 91 percent of clients say they are somewhat, or very comfortable, providing a referral, only 29 percent actually provided a referral. We describe this challenge as a ‘referral gap.’ Despite the fact that 58% of engaged clients say they are fundamentally motivated to refer in order to say ‘thank you’ to their advisor, few take action unless there is a clearly stated need on the part of a friend or family member. We call this a ‘motivation gap’.”

It is these gaps that have prompted countless generations of sales managers to conclude, “All we have to do is ask for referrals.”

But it does not work that way.

“Advisors are often taught to ask for referrals, and ask often. The data suggest that a better approach is to help clients to spot a good referral opportunity so that they recognize the opportunity to share your name. That opportunity is not likely to be as obvious as a client being asked for the name of a good financial advisor. Rather, the opportunity might involve a client speaking with a friend who has lost a spouse, a colleague who is selling a business, or a family member who is hoping for early retirement. The need triggers the opportunity for a referral; your clients need to recognize that need.” Emphasis added.

How do you do this? For years, I’ve called it “Promote Referrals.” I have defined this as “the art of gently and persistently reminding your clients you value and accept referrals.” Consistently reminding clients you value and accept their referrals, does in fact increase referral business. Based on Ms. Littlechild’s research, I’m now abandoning the term, “Promote Referral” and incorporating it into a new term: “Induce Referrals.”

The new sales commandment is: Continually educate clients to recognize referral opportunities and gently and persistently remind them their referrals are valued and accepted.

This actually lies on top of my “Client Relationship Retention Formula” which, interestingly, incorporates many of Ms. Littlechild’s service dimensions. I guess good service really is common sense, and any two or three people who define great service will come up with similar or identical dimensions.

The word “induce” is a near perfect word to describe this process. Per the American Heritage online dictionary, “To induce is to lead, as to a course of action, by means of influence or persuasion.”

A Plan to Increase Financial Advisor Referrals

- Read “Anatomy of a Referral.” Take very good notes of service dimensions rated highly by engaged clients, but which are sore point in your practice.

- Evaluate the “goodness” of your clientele. This requires a bit of explanation on my part, and work on your part. Keep reading.

- I would then review various combinations of “A” clients, Engaged Clients, and Wealthy Clients, and correct any sore points found.

- Have a referral conversation with every client at review time. Educate them on referral opportunities.

Client Goodness Explained

In my September 2010 Research Magazine article, “Brace for Impact,” I directed you to a spreadsheet we had developed, “Evaluating Client Goodness.” In that spreadsheet, we showed you how to evaluate your clients on the basis of “responsiveness” and “wealth.”

An “A” client is someone who has complete trust in your recommendations. Since you do not know how your clients rate you on satisfaction and loyalty, we have to rely on something you do know: responsiveness.

Here is the tie in: According to Ms. Littlechild, “A referral is a transfer of trust. When you think about it, it’s one of the most tangible actions a client can take to tell you that they trust you.” (p. 3)

Another tangible action is: The client always, or mostly, follows advice.

You can estimate the trust factor by noting the degree of responsiveness to your recommendations.

So that you can add the “Engaged” Client dimension to your evaluation of client goodness, we have updated the spreadsheet with two columns: “Referred by” and “# referrals provided 2008-9.” The spreadsheet, along with a complete explanation of “client goodness” is on the “Real Referrals” website.

This analysis will do three things for you:

- Identify your referral networks: Bob Barking referred Al Schnall who referred Velda Oldebucks. These are people who provided referrals who became clients, and these names certainly tell you where to focus your relationship maintenance time and dollars.

- Identify your Engaged Clients. Per definition, “It’s anyone who has provided a referral.” Interestingly, the survey shows a small percentage of “Disgruntled Clients” having provided a referral. The only explanation I can imagine for this is that these were former “Engaged Clients” with corresponding high satisfaction and high loyalty rates. Something you did or did not do caused them to dive into the disgruntled pool.

- Direct you to relationships in need of improvement. “Induce Referrals” is a recipe. It has many ingredients. Properly prepared and baked, you get a beautiful referral cake.